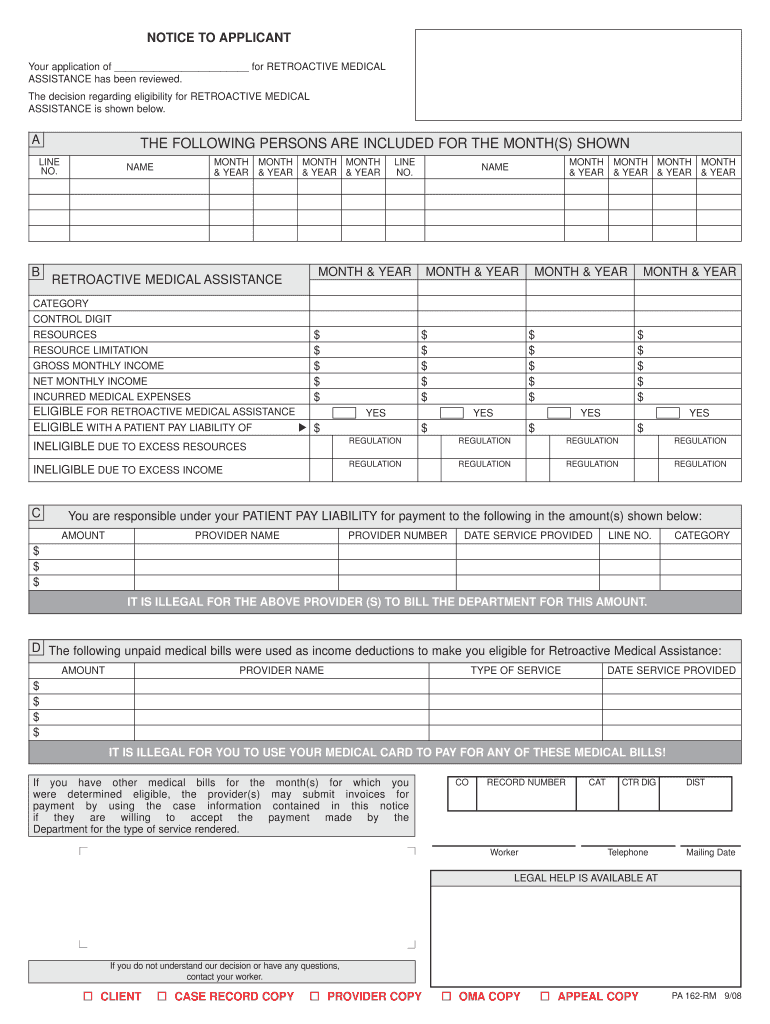

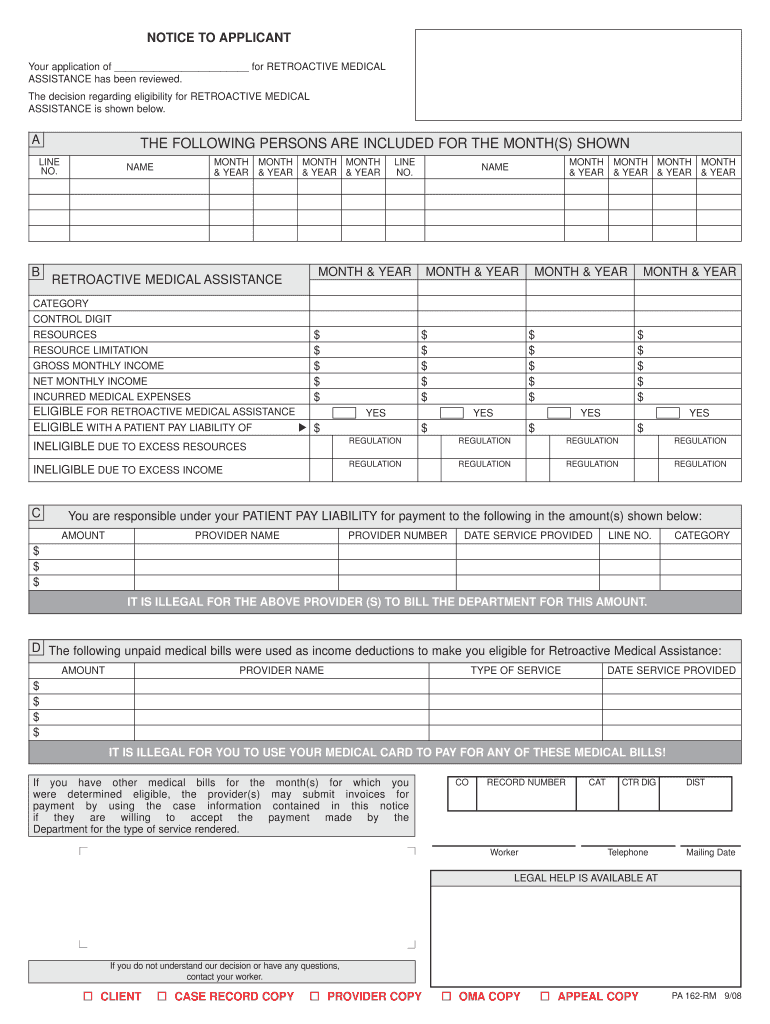

PA 162-RM 2008-2024 free printable template

Get, Create, Make and Sign

Editing pa 162 form online

How to fill out pa 162 form

How to fill out pa 162?

Who needs pa 162?

Video instructions and help with filling out and completing pa 162 form

Instructions and Help about pa fs162c form

Music we are experiencing the greatest technological and economic shift in human history we need a way to help millions of Americans transition through this period and a universal basic income is the best and most efficient way to do that hello I'm Andrew yang and I'm running for president as a Democrat in 2020 I believe I have the right vision priorities and values to improve the lives of millions of Americans seven years ago I started venture for America to train hundreds of young entrepreneurs to build businesses in Detroit Cleveland Baltimore and other communities across the country together we helped create thousands of jobs but during this time I came to realize that technology has already wiped out 4 million manufacturing jobs in Ohio Michigan Pennsylvania and other states and it's about to do the same thing to people who work in retail food service and food prep customer service transportation as well as industries like insurance accounting medicine and law I saw so much over the last number of years traveling this country what I experienced was I opened her to me where I would walk through abandoned neighborhoods and boarded up businesses I have two young boys and I'm deeply concerned about the future that they're going to grow up in if we don't change things dramatically they're gonna grow up in a country with fewer and fewer opportunities and a handful of companies and individuals reaping the gains from new technologies while the rest of us struggle to find opportunities and eventually lose our jobs and it doesn't need to be that way under my plan every American adult will receive 1000 a month free and clear paid for by a new tax on the that are benefiting most from automation if we provide a universal basic income Americans will be able to go back to school move for a new opportunity to start their own business and really have their head up as they plan for the future with your help we can make universal basic income a reality join us let's build a new kind of economy one that puts people first Music what's up everyone welcome to simulation what a cool video that we just watched we have an amazing episode for you we're gonna be talking about universal basic income aka the freedom dividend we're gonna be talking about putting humanity first over the markets our guest today is Andrew yang Andrew thank you for coming out of the show thanks for having me on it's a pleasure to be here Andrew you are a President presidential candidate so we'll get a little handshake we a presidential candidate for 2020 Democrat yes we you are an author of the war on normal people yep which is actually a fantastic book I really recommend going and reading that book we you're also the founder of venture for America over the last seven years now you guys have been working on teach us about venture for America teaches about the last seven years teach us about everything that's going on man because this is the most important moment in humanity's kind of coming...

Fill pa 162 notice pa : Try Risk Free

People Also Ask about pa 162 form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your pa 162 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.